86 the Cappuccino

June 2025

After years of market froth—rate drops, bidding wars, and pandemic-fueled urgency—we’ve officially transitioned to something more grounded. The economy is cooling without cracking. Inflation is easing, the Fed isn’t flinching, and housing? It’s no longer running on caffeine and chaos.

This month’s market update digs into the split-screen reality across Denver: detached homes are normalizing, while attached listings face a more price-sensitive crowd. Demand is still there—but expectations are adjusting. Quickly.

If you're wondering where things are headed, here's the short version: no more frothy surges, no full-blown correction either. Just a slower pour, steadier footing, and outcomes that depend more on substance than momentum.

The Skim:

-

How Do You Like Espresso...?

-

Detached: Normalizing After a Wild Ride

-

Attached: Softer, Slower, and Buyer-Sensitive

How Do You Like Espresso...?

The economy continues to settle into a slower, more sustainable rhythm. Inflation is easing—headline CPI is now 2.4% YoY, and Core PCE remains at 2.5%—but the path to 2% is still uneven. Goods prices have largely stabilized, while services inflation, especially in housing and insurance, is proving stickier. Wage growth of 3.9% YoY shows that households still have spending power, but the Fed isn’t signaling urgency to cut. With rate cuts now likely pushed to late 2025—or even 2026—markets are adjusting to the idea that high-for-longer might actually mean what it says.

Labor and housing trends echo this rebalancing. May’s job growth came in at 139,000, softer but steady. Unemployment held at 4.2%, though jobless claims and voluntary quits are both creeping higher. In housing, new home sales surged 10.9% in April, buoyed by builder incentives and rate buydowns, while pending home sales dropped 6.3%, suggesting buyer hesitancy still looms over the resale market. Mortgage rates remain stuck near 6.9%, dampening activity without forcing price corrections in most metros.

Consumer sentiment is improving, but gradually. Retail sales were down -0.9% in May, and durable goods orders posted a notable pullback. But households still appear resilient—spending more carefully, not collapsing. It’s a slower cycle now. Not a bust, but a come-down. The froth is gone.so cappuccinos are off the menu—for now, it’s espresso for everyone.

Detached: Normalizing After a Wild Ride

Attached: Softer, Slower, and Buyer-Sensitive

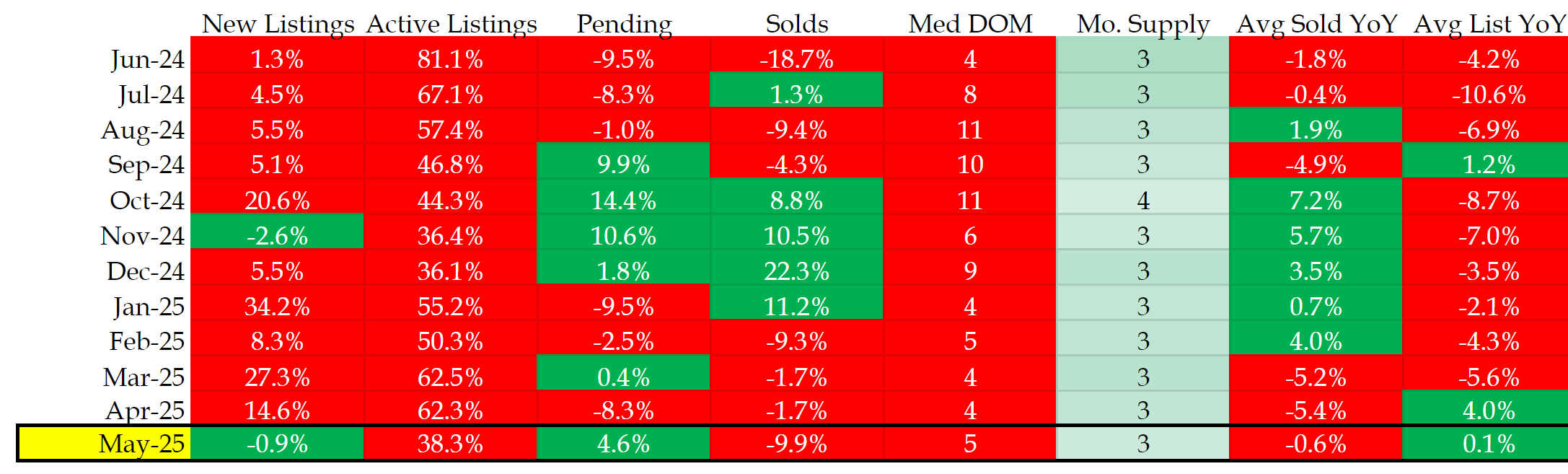

Let’s check in on our trusty table summarizing the market conditions summarizing the market conditions in the Denver metro area:

All data sourced from REColorado on June 15, 2025.

(We're trying a new format for our market commentary this month given the continued divergence in the detached and attached market segments. Hopefully, this form gives a bit more detail on what's happening right now!)

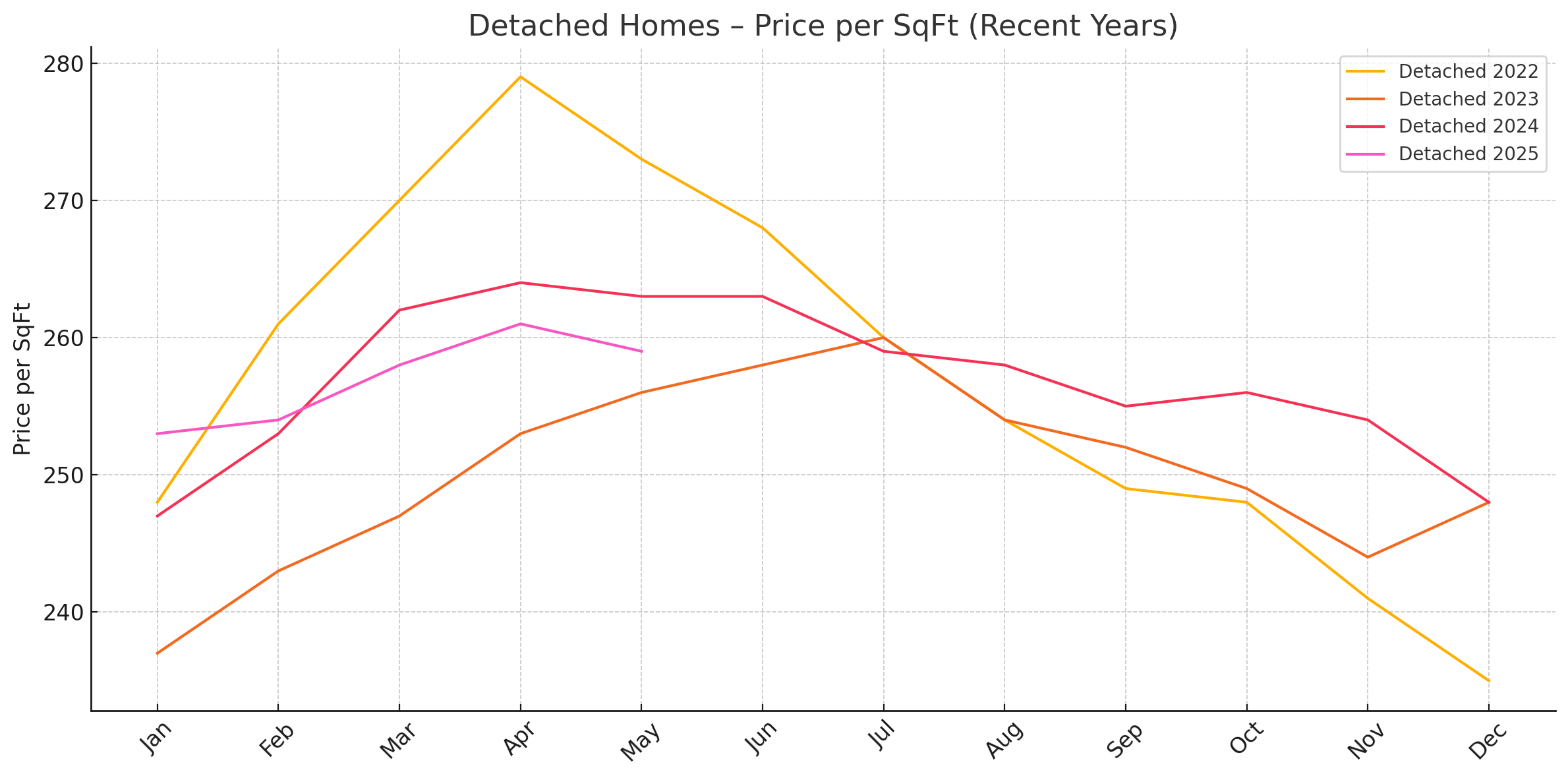

Detached Market: Normalizing After a Wild Ride

Detached homes across the Denver Metro are continuing their slow, steady slide back to reality—but let’s be clear: this is a return to normal, not a crisis. The average price per square foot for detached properties came in at $259 in May, down slightly from $263 last year, and just a notch below $256 in 2023. That’s a modest -1.5% year-over-year dip, well within the range of seasonal market movement. Zoom out and the picture is clear: detached homes are still up 83% over the past decade. Long-term owners are sitting on serious equity, and even those who bought in 2020 or 2021 are generally ahead.

All data from REColorado on June 15, 2025.

All data from REColorado on June 15, 2025.

What we’re seeing now is the post-froth adjustment. The runaway price acceleration we experienced from 2020 to 2022 isn’t coming back anytime soon, and that’s not necessarily a bad thing. Buyers are behaving more cautiously, DOM is ticking up (from 9 days in May 2024 to 13 days this year), and pricing strategy matters again. That doesn’t mean homes aren’t selling—they are. But it does mean sellers need to be aligned with today’s market, not yesterday’s comps.

For homeowners, especially those who plan to hold for several more years, this environment still supports long-term growth. And for those considering selling, the key shift is psychological: pricing expectations need to reset. The market’s not rewarding hopeful list prices right now—it’s rewarding clean, compelling properties that are priced in line with buyer sentiment.

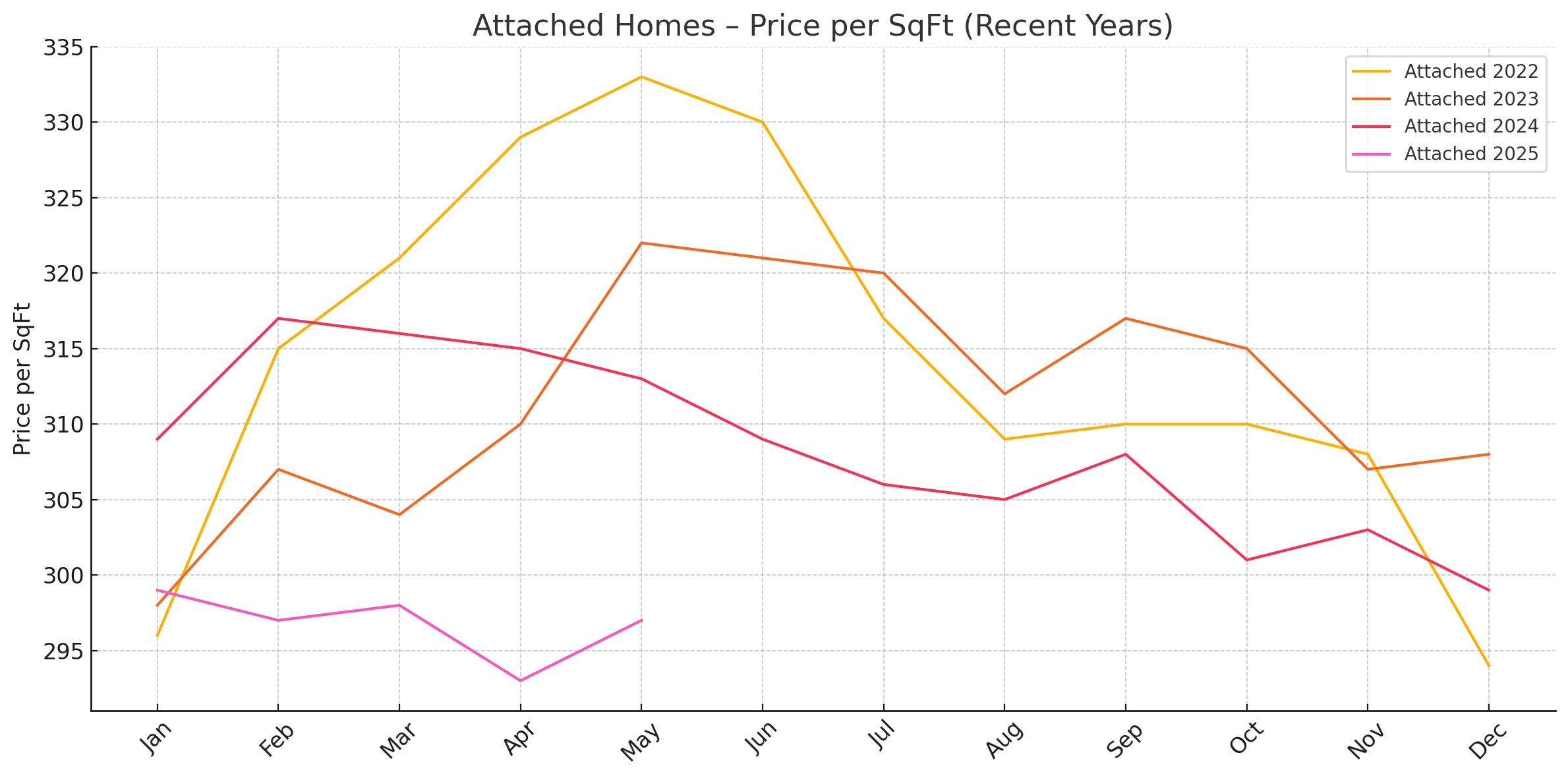

Attached Market: Softer, Slower, and Buyer-Sensitive

The attached segment—think condos, townhomes, and smaller footprint inventory—is under more noticeable pressure. The average price per square foot in May landed at $297, down from $313 in 2024 and $322 in 2023, for a total decline of -5.1% year-over-year. That’s not catastrophic, but it is material—especially when you consider that attached properties have now given back nearly two full years of gains.

All data from REColorado on June 15, 2025.

All data from REColorado on June 15, 2025.

There’s a simple explanation here: affordability. As rates remain elevated and HOA dues continue to eat into monthly budgets, buyers in this segment are increasingly value-conscious. We’re seeing more negotiating, longer listing periods, and in some cases, meaningful price reductions to get deals done. Sellers in this segment haven’t all caught up to the market’s mood, and it’s showing in the stats. Attached properties didn’t get the spring bump we usually see—prices actually slid from $298 in March to $293 in April, and barely recovered to $297 in May.

Buyers are clearly willing to engage, but they’re not rushing. The days of “list it Friday, under contract Sunday” are behind us—at least for now. Attached sellers who price optimistically and wait for magic are often sitting. But those who meet the market are still closing deals—just with a bit more give and take than they might’ve hoped.

Outlook & Espresso: Strong, No Foam

We’re heading into summer with a market that feels… calmer. Not collapsed, not booming—just level. And in this environment, realism wins. The data supports the notion that we’re past the high-froth era, but not entering a downcycle either. Detached homes are holding their value surprisingly well, and even the attached segment—while softer—isn’t unraveling. This is a rebalancing, not a retreat.

For buyers, especially those who’ve been sidelined for months or even years, this could be an opportunity window. No, rates aren’t ideal. But less competition and more leverage in negotiations can still net great outcomes—especially if the right agent is guiding the process.

The takeaway? This market isn’t serving cappuccinos anymore. The foam is gone. What’s left is strong, grounded, and all espresso. And that’s not a bad thing.

(Publication assisted by AI with ChatGPT)