Taking a Break

May 2025

Markets don’t pivot in silence—they catch their breath first. After a volatile April full of whiplash-level data and policy jitters, May feels like the first real exhale we’ve had in a while. But don’t confuse this pause for peace. Beneath the surface, uncertainty is still quietly compounding. Globally, rhetoric is softening and central banks are stepping back—but they’re not stepping away. Locally, Denver’s market is waking up fast on the demand side, even as the supply picture gets more bloated and bifurcated by the week. Buyers are alert but constrained. Sellers are energized but unrealistic. And just like the Fed, we’re all in “wait and verify” mode—watching to see which pressure breaks first. This month’s update breaks down where signals are stabilizing, where fragility remains, and why “calming” might be the most dangerous narrative of all if you’re not paying attention.

The Skim:

-

Calming, Not Clarity

-

Demand: Eyes Wide, Wallets Tight

-

Supply: Hopeful but High

Calming, Not Clarity

After the shockwaves of April, May has brought something else entirely: a pause. Markets have largely recovered—equities bounced sharply from their late-April lows, crypto roared back with Bitcoin regaining the $100K+ range, and volatility measures like the VIX retreated toward pre-spike levels. Even Treasury yields, which spiked in April amid rate cut repricing, have stabilized in the 4.4–4.5% range on the 10-year, signaling that bond markets are buying into the idea of a “higher for longer” but not the "what just happened” regime.

The Fed’s May 7 statement matched that mood. While Q1 GDP contracted by 0.3%—a full 80bps below expectations—the Committee attributed the miss in part to volatile net exports, likely the result of tariff-driven import pull-forwards in Q4. Under the surface, the data looks less dire. Core PCE was flat in April, showing no signs of an inflation reacceleration. Non-farm payrolls came in line, the unemployment rate held steady at 3.9%, and while manufacturing activity remains in contraction, services continue expanding—albeit slowly. Translation: the underlying economic engine is still running, but the Fed is wisely keeping its foot on the brake. The risk isn’t an overheating labor market or collapsing growth. It’s a misstep while the system is still absorbing April’s turbulence.

You can see that caution elsewhere, too. Credit spreads widened last month but have since tightened modestly, suggesting investors aren’t seeing systemic risk. Consumer sentiment, while softening, hasn’t collapsed—pointing more to uncertainty than fear. And geopolitically, there’s been a notable shift in tone: the trade announcement with the UK was vague and early, but still a marked departure from the accusatory rhetoric of March and early April. Even conversations around China—while still tense—have reopened through formal channels.

So what does that mean? We’re not in a recovery; we’re in a recalibration. Markets, central banks, and policymakers are all waiting to see how much damage April really did. The Fed’s decision to hold rates steady isn’t a green light—it’s a reminder that inflation risks remain elevated and that the burden of proof for a rate cut is still very high. Until we see how consumer behavior, trade flows, and pricing trends evolve over the next few months, any optimism should be tempered. This moment feels better than last month only because last month was a shock. Calm isn't the same as clarity—and in this cycle, macro economic patience is still the winning trade.

Demand: Eyes Wide, Wallets Tight

Supply: Hopeful but High

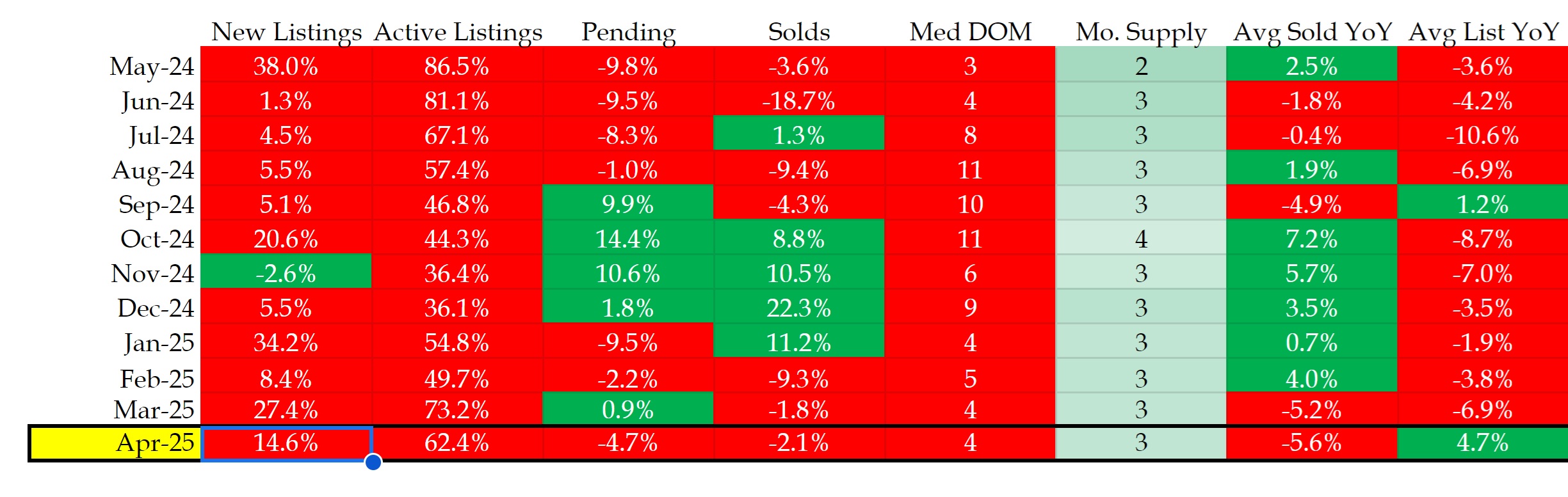

Let’s check in on our trusty table summarizing the market conditions summarizing the market conditions in the Denver metro area:

All data sourced from REColorado on April 14, 2025

Locally, the story hasn’t changed much since April—but that’s exactly what makes it notable. After several months of national market volatility and shifting macro sentiment, the Denver housing market has found a kind of uneasy rhythm. The detached and attached segments are increasingly moving in different directions, and that divergence is starting to create real strategic implications for sellers, buyers, and investors alike.

Let’s start with the detached market, which continues to show the strongest signs of health. Median days on market dropped to 7 in April, a level we typically associate with hot spring activity. Buyer behavior supports that trend—we’re seeing many of our brokerage’s listings go under contract in the first weekend, but only when priced appropriately. That caveat is crucial. The average sold price in April was $817,000, down about 8% year-over-year, even as sales volume was up 6% over the same period. In other words, the market isn’t cold—it’s just capped. Buyers are still out there and willing to act quickly, but they’re price-sensitive and acutely aware of their monthly payment limits. This is what a demand-constrained affordability market looks like.

Sellers, however, are operating with a different frame. The average list price in April jumped to $938,000, marking the first time we’ve crossed the $900K threshold in over a year. That’s also 14% higher than the average sold price—a significant and growing delta. This disconnect reflects a now-familiar standoff: buyers think it’s 2008 or 2020 and want a deal; sellers think it’s 2021 or early 2022 and want top dollar. They both can’t be right. And as long as that psychological gap remains, pricing will stay range-bound—even if volume remains elevated. We’re not seeing a lack of demand, we’re seeing misaligned expectations. And that misalignment is slowing down an otherwise ready market.

The attached segment, by contrast, is steadily weakening. While median days on market did fall to 21, that’s still triple the time it takes to move a detached home. And April marked the fourth consecutive month where new listings (1,025 units) outpaced pending contracts (469 units). The result? Inventory is building—active listings rose to 2,604 units—and we now estimate 5+ months of supply in the attached space. That’s a critical threshold where the market begins to shift toward buyers, who now have more options, more leverage, and more reasons to wait for price cuts.

The average sold price for attached homes was $451,000, up just slightly from the prior month, but still lagging well behind where it was last spring. That soft performance is especially noticeable in central Denver condos and townhomes, which are seeing longer hold times, more frequent price reductions, and slower buyer engagement. The trend toward detached, suburban properties is still in full force—and for good reason. With affordability stretched and lending standards steady, buyers want more space, more value, and fewer compromises.

But here’s where it gets interesting: the growing imbalance in the attached segment may create opportunities. Investors and cash buyers—particularly those looking for rental yield or appreciation upside—should start paying close attention. The window isn’t wide open yet, but it’s opening. Rapid inventory build, longer DOM, and softening seller expectations all point to the early stages of a market cycle that can offer outsized upside to well-positioned buyers. The key? Do your homework. Focus on attached units with healthy HOAs, reasonable assessments, and long-term rental viability. The inefficiency is back—but only for those willing to dig.