Oh, Barry Barry

Maybe second to a George Friedman podcast, nothing gets the macro juices flowing on a Saturday morning like watching an interview with Barry Sternlicht, the Chairman & CEO of Starwood Capital Group. Even if you never read one of these emails beyond “The Skim,” you should take thirty minutes out of your day, grab a beverage, and enjoy hearing the perspective of what’s going on in the world from someone who has access to all the data he wants. Even though Mr. Sternlicht tends to argue for his book a bit (and who doesn’t when you’re responsible for financing billions of dollars a year), we do agree on 95% of the current landscape and that means our views are starting to converge a bit more. In these Insights, we will unpack some of the most interesting points from Mr. Sternlicht’s fireside chat and discuss the impacts on Colorado’s real estate market.

The Skim:

The Rock and the Hard Place.

Demand – Tepid

Supply – Building…?

The Rock and the Hard Place

If you watch the fireside chat with Barry Sternlicht, pay special attention to the moderator. Once Mr. Sternlicht gets going, she does an incredible job of emulating the Blue Pebble Team’s reactions when I go off on my insane macro tangents during our once-a-month market calls. (If you would like to witness the spectacle, we’d be happy to have you! Send us a note and we’ll add you to the invite.)

During their 30-minute chat, Mr. Sternlicht covered his thoughts on topics ranging from AI, data center architecture, inflation, the office market, government economics, and more. We will do our best to unpack a few of the nuggets that Mr. Sternlicht left for us…

Artificial Intelligence — From minutes seven through nine, Mr. Sternlicht goes on a tangent and seems to insert a bit more of his own, unfiltered commentary about the regulatory environment and artificial intelligence. If you assume that someone of his means is better connected to the people in the room making these decisions and also sees more data about the issues with AI, that makes this section even more important. He seems to have a legitimate fear about the potential risks posed by AI without a holistic regulatory framework, and that’s interesting.

Data Centers — The thesis driving Starwood’s investment in data centers is fascinating and makes a lot of sense. He also draws connections from America’s energy reserves to our ability to build data centers and the implications that will have on America’s future economic competitiveness. In summary, because America has a lot of cheap natural gas, we can power our data centers unlike Europe; furthermore, according to Mr. Sternlicht, China walled off their economy, so their data set is incomplete. As a result, he argues that American companies will continue to have a huge competitive advantage on the data side when competing in global markets. When he goes so far as to say that Congress will likely codify American companies’ abilities to collect data on their consumer, he touches on a really interesting debate — at what point do privacy concerns become as big of an issue in America as they are in other areas around the world? If ever…

Inflation — This is where Mr. Sternlicht and I have typically disagreed over the last few years, and the gap between us is starting to narrow. He’s been saying the same thing about rents and the Fed using the wrong data set for years, and it seems like he’s finally coming around to the fact that rates aren’t going to come down as quickly as he would hope given his preferred data set. But… we still disagree on the reasoning. If you watch that section of the video (minutes 13-20), you’ll note that he gives up at the end and acknowledges that Powell won’t lower rates because he believes the Fed Chair is more concerned about his legacy than what’s economically correct. While that might end up being the case, Powell has one HUGE trump card that Mr. Sternlicht didn’t discuss, and that’s the labor market. So long as unemployment is low, wage growth is over 4%, and the public sector hasn’t cut any spending, the Fed Chair has no choice but to kill the private economy to keep inflation at bay.

Office Market — It’s a bloodbath and a race: will US companies get their employees back in the office before the regional banks are forced to foreclose on office building owners?

Municipal & Federal Budgets — This is another major topic that only gets a couple of minutes in the video and is EXTREMELY important. Higher interest rates mean slower transaction volume across real estate & finance as well as lower property values. As a result, tax receipts are behind where municipalities and the federal government projected, so it seems the only way out is to increase taxes and cut spending. This kind of austerity is what Europe went through coming out of the financial crisis, while the US took the step of quantitative easing and printing money. Let the good times roll!

Our biggest takeaway from the entirety of the video is that the cognitive dissonance in the macro landscape is slowly being resolved. Market participants seem to be coming to grips with the facts suggesting some pretty systemic changes are needed in our financial and economic systems as the runway to keep the status quo is running out. The implications for the residential real estate market will be more of the same, for now. Higher interest rates mean higher mortgage rates, lower transaction volumes, and expensive new construction. It doesn’t seem like this will change until there’s a major shift in the jobs market, and that’s a long way away.

Demand – Tepid

Supply – Building…?

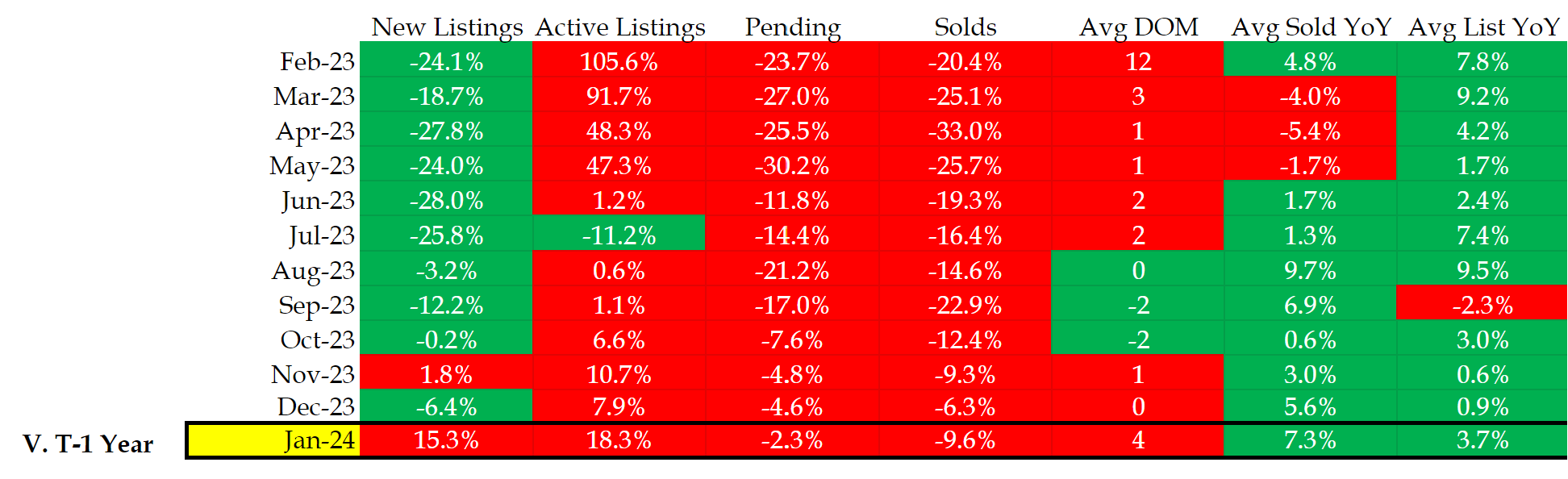

Let’s check in on our trusty table summarizing the market in the Denver metro area:

Data taken from REColorado on Feb. 10, 2024. Area covers the circle with a 10-mile radius surrounding Union Station in downtown Denver, CO.

The normalization in the real estate market data is something we’ve been watching for several months, and January continued that trend. Given the normalization that’s occurred, it was easier to identify the 15% increase in new listings that hit the market in January 2024 vs. the year prior. You read that correctly! We finally saw more listings hit the market last month!

But why did we see new listings come on the market at a faster pace? And do we think that’s going to continue…? Our answer is “maybe.”

Even though it doesn’t feel like it, we could be in a Goldilocks environment for Denver and Front Range Real Estate right now. Mortgage rates have come off their highs and are splitting the difference between rates we saw in 2022 and 2023. As a result, those who have been on the sidelines waiting to move are feeling a little bit of relief on their monthly payments and are more inclined to transact. I think this could be especially true for Baby Boomers (and other homeowners) who have wanted to downsize and would have previously been unable to afford their new monthly payments.

Here’s a quick example… Let’s say you own a $500k house and have a $250k mortgage balance paying a 2.75% interest rate on a 30-year fixed that you bought in 2015 and refinanced in 2021. Your monthly payment would be around $1,500 for your home. Now, let’s say that you wanted to downsize from a $500,000 home to a $400,000 and roll your $250k of equity into the deal in 2024. If you had looked to transact that home when rates were 8%, then you would have ended up paying a bit over $1,430 per month — and this also assumes no transaction fees like commission or mortgage points. A lot of people had second thoughts about going through the hassle of listing their home for sale and moving into something smaller if it didn’t make economic sense.

The economics of this scenario are a little different now. Clients who transact with Blue Pebble Homes and Blue Pebble Loans are getting interest rates on the order of 6.5% for 30-year, fixed, conventional financing. (We’re not bashful about the rates we offer, and you can check those out in real time here!) If you apply a 6.5% mortgage rate to the downsizing scenario, your monthly payments would drop from over $1,430 per month down to $1,281 per month, and now we’re talking about savings that might encourage someone to move.

Without a major dislocation in the jobs market, this is our best explanation for why there might start to be more listings hitting the market this year than we saw over the last 18 months. And, if this thesis is true, it’s likely a very fragile equilibrium. If mortgage rates drop below 6.0%, then it’s very likely we’re going to go back to bidding wars and insanity since there’s still not a lot of supply on the market. And if rates go back to 8.0%, things probably slow down to the point they did last year when people were priced out of selling.

Thanks for stopping by this month! Please, reach out if you have any questions and click here if you want to sign up and receive next month’s edition in your inbox.

– Jared